BELMONT WOODS HOMEOWERS' ASSOCIATION

ASSESSMENT COLLECTION RULES AND REGULATIONS

1. Introduction. The Association requires a steady, dependable cash flow from assessments to conduct its operations, maintain common areas and facilities enforce covenants and rules, and otherwise manage and administer the affairs of the Association.

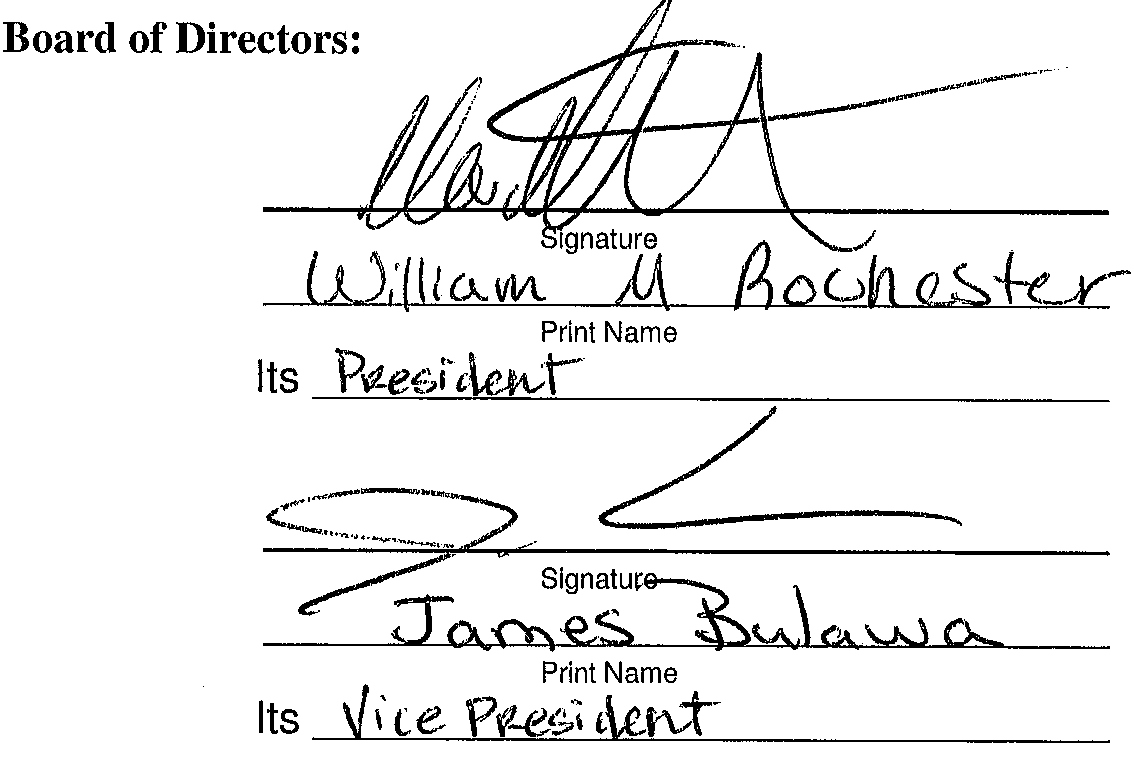

2. Statement of Authority. The Association, acting by and through its Board of Directors, is responsible for collecting assessments from owners pursuant to the Declaration of Covenants, Conditions, and Restrictions for Belmont Woods Homeowners' Association (the "Declaration"), and Homeowners' Association Act, RCW 64.38 (the "Act").

3. R&Rs Adopted. These Assessment Collection Rules and Regulations were adopted by the Board of Directors for the purpose of establishing a uniform and consistent manner of collecting assessments. These rules and regulations replace any previous written or unwritten policy on this topic.

4. Assessments.

4.1 Definition of Assessments. As used in these rules and regulations and pursuant to RCW 64.38.010(1), "Assessment" means all sums chargeable to an owner by an association in accordance with RCW 64.38.020.

4.2. Obligation to Pay Assessments. "Each Owner of any Lot, by acceptance of a deed therefor, whether it shall be so expressed in each deed, is deemed to covenant and agree to pay the Association (1) annual assessments or charges, (2) special assessments for capital improvements..." See Declaration, Article VIII, Section 1.

4.3 Annual Assessment Due Date. Article VIII, Section 7 of the Declaration of CC&Rs provides that "due date [of the annual assessment] shall be established by the Board of Directors. Now, therefore, the Board establishes a due date of January 1st for the payment of annual assessments; except that the due date will be February 1 for the payment of 2015 annual assessments only.

5. Interest, Late Fees, and NSF Charges.

5.1 Statutory Authority to Impose Late Fees. Washington statute, RCW 64.38.020(11), provides that the Association may impose and collect charges for late payment of Assessments.

5.2 Late Fee for Non-Payment of Annual Assessment. A late fee of $50 will be charged against a delinquent owner and his/her lot, if the Association has not received payment, in full, of the annual assessment by the following dates: January 30th, April 30th, July 31st, and October 31st. Total late fees for nonpayment of annual assessment for a calendar year could total $200.

5.3 Interest. Consistent with Article VIII, Section 8 of the Declaration of CC&Rs, "Any assessment not paid within thirty (30) days after the due date shall bear interest from the date at the rate of 12 percent (12%) per annum."

5.4 Billing for Late Fees. Interest or NSF Fees. The Association is not required to formally bill the owner for late charges, interest, or NSF fees, as they automatically accrue on the dates set forth herein and in the Declaration.

6. Collections and Application of Payments.

6.1 Collection by Attorney: The Association, by and through its Board or manager, may send any delinquent account to the Association's attorney for collection if said account has a delinquent assessment balance over $500.00; provided that, the Association has first given the owner written notice that his or her account is delinquent in excess of $500 and that the failure to cure the delinquency within fifteen (15) days of the date of the letter will result in said owner being turned over to the Association's attorney for collections. The costs of collection, including without limitation, costs related to preparing and recording a Notice of Claim of Lien and reasonable attorney's fees, shall be recoverable from the delinquent owner, pursuant to Article VIII of the Declaration, whether or not such collection activities result in suit being commenced and prosecuted to judgment.

6.2 Application of Payments. Payments from owners with delinquent assessment balances will be applied by the Association to the oldest assessment charges first, and then to newer charges, based on the date that said assessments became due.

7. Payment Plan Policy. In keeping with the ideal of courteous and respectful relations between the Association and individual owners, it is recognized that there may be occasions where an owner is unable to pay part or all of his or her assessments, and has become delinquent, due to a family tragedy or other event which has severely impacted an owner's finances and the ability to pay assessments. In this case, the Association reserves the right to exercise discretion in its assessments enforcement from time to time, where it determines that the failure to pay assessments is due to reasons beyond the owner(s)' control or other legitimate factors exist which effect the ability of that owner to pay at a particular point in time. Accordingly, the Association reserves the right to accept reasonable installment payment plans, where verifiable hardships exist and doing so does not unduly or unreasonably harm the Association, subject to such terms and conditions as the Board may determine in its sole discretion.

8. Effective Date. A copy of this Rule shall be furnished to each Owner by mailing or delivering a copy of the same to each owner at his or her last known address, This Rule shall be effective on the date it is mailed and/or delivered to the owners.

DATED AND ADOPTED January 7th, 2015